As a marketing professional, I am highly aware that presentation is everything.

In my opinion, there are several marketing hacks that the health care industry could adopt to increase plan participation and to better position certain programs in a more positive light. Today’s subject: The dreaded High Deductible Health Plan.

While HDHPs can be an appealing health care option for both employees and employers, mainly due to the cost-effective nature of the plan design, employees are often not fully educated on the benefits of this plan and are initially turned off by the abrasive name. High deductible? No thanks.

By better educating employees on both the pros and cons of this popular health plan option, you can empower employees to make better benefits decisions.

Benefits marketing

In marketing, it’s important to tout several aspects of your product at different stages of the sales process. Benefits shopping can also be thought of as a sales transaction. Though it is important to offer a well-balanced benefits spread to remain competitive, there are inevitably certain options that are more appealing to your bottom line. So, effectively positioning these programs within your organization can increase participation and keep costs to a minimum.

A feature is a matter-of-fact statement about a product or service. You can think of features as the “bells and whistles.” In a benefits context, this might include a statement about the types of plans offered: “We offer two PPO options and an HDHP plan with an HSA.”

Feature talking points might include the types of plans offered, information about deductibles and network restrictions, etc. Many benefits and human resources professionals outline important health plan feature — and stop there.

While clearly communicating the features of your benefits offerings is important, adding in a persuasive layer related to the actual benefits of your perks will go a long way in helping employees understand the true value.

A benefit statement refers to the actual value that a feature provides. How will these features actually impact a person, and why should they care? For example: “The HDHP is half the cost of our PPO options, which will save you more than $1,200 annually on the cost of your health insurance premiums.”

Benefit talking points might include the value of a comprehensive network (convenience), the low cost of an HDHP (savings) or the added-value of health savings accounts that can be used to offset unexpected medical costs (safety net).

Take time to extrapolate the benefits of your perks, including the HDHP, and clearly and concisely convey the highlights in all of your employee communications.

Focus on education

High deductible health plans, with their low premiums and broad or even no networks, can be a great option for many employees. However, they come with risks. Those with chronic conditions will pay more out-of-pocket than with a traditional plan. There’s also the potential for employees to defer doctor visits until symptoms become severe and treatment more expensive.

Some of these risks can be lessened by offering a savings option with an employer contribution. A Kaiser Family Foundation study found a substantial percentage of workers in an HDHP receive an account contribution from their employer which reduces or even eliminates the deductible.

Some of these risks can be lessened by offering a savings option with an employer contribution. A Kaiser Family Foundation study found a substantial percentage of workers in an HDHP receive an account contribution from their employer which reduces or even eliminates the deductible.

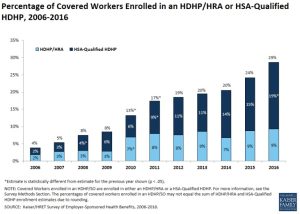

Despite the potential financial risks of HDHPs, the percentage of employees participating in them has grown dramatically, from 4% in 2006 to 29% a decade later. The lower premiums coupled with a savings option, has proven an attractive alternative to PPO and POS costs.

And even with an employer contribution, it’s no secret that these low-cost plans are more affordable for employers, so HDHP plan adoption should be a priority for HR teams during open enrollment. However, don’t wait until open enrollment rolls around to start touting the benefits – and educating about the risks — of a high deductible plan. Rather, offer easy to access educational materials throughout the year and encourage employees to engage with materials well in advance of open enrollment.

How can your HR team shine a light on HDHPs? Focus on the benefits!

- Lower premiums than PPO or POS plans.

- Network availability is not as narrow as an HMO plan.

- Rare users save – people who have a low usage rate will save money.

- Avoid market rate – out-of-pocket expenses are actually negotiated between health care provider and insurance carrier.

- HSA eligible – employees and employers can both contribute, money contributed is tax-free, and the account stays with the employee.

Use multiple communication methods – email, print materials, educational videos, carrier pigeons, etc. – for the best results.

Offer a Health Savings Account

The best way to sell your HDHP? Offer a complementary benefits account. Flexible spending accounts (FSAs) are the most popular option, though health savings accounts (HSAs) and health reimbursement accounts (HRAs) are also available to help offset the burn of high deductible plans.

Benefit accounts are essentially savings accounts for health purposes. Though different plans offer specific nuances, benefits accounts allow both employers and employees to contribute to the savings account throughout the year and then pull from savings to pay for health care costs.

Decision support

Employees might harbor hesitation when it comes to taking recommendations from an in-house benefits representative. Though remaining unbiased and recommending the appropriate plan on an individual basis is an important part of administering benefits, there will inevitably be a percentage of your employee population that will be slow to accept an HDHP recommendation. However, offering easy to access decision support tools can help ease employees’ minds when it comes to their benefits recommendations. Decision support could include hosting brokers or carriers in-house to answer employee questions or using a benefits administration technology that offers real-time decision support during the benefits shopping experience.

Alternative names for your HDHP

It’s time to rebrand your HDHP! Here are a few ideas to help reposition your affordable health plans.

- Healthy Saver Plan

- Smart Saver Plan

- Savvy Shopper Plan

- Consumer’s Choice Plan

- Simple Savings Plan

- Affordable Health Plan

Keep in mind, the point of re-naming your HDHP is not to deceive employees, but rather to strip away negative connotations associated with the existing name and showcase the plan in a more positive light. Better positioning paired with better employee education and decision support can help increase employee understanding and participation over time.